China is the second-largest global economy, the largest exporter, and has the largest exchange reserves in the world. However, even though China has one of the fastest-growing GDPs in the world, its economic growth was abruptly slowed due to the impact of the COVID-19 pandemic. With all the volatility and uncertainty surrounding the Chinese economy right now, some companies that manufacture their products in China are starting to worry about how it may affect their business. As a result, many businesses are moving to Thailand. It includes Jewelry Manufacturing Production. Learn more about the Challenges of Doing Business in China Vs Investing in Thailand for Business Success.

China’s economy, having weathered the trade war and jolted by the impact of Coronavirus. Changing China’s crackdowns are impacting businesses, and these problems are becoming increasingly worrisome for investors.

Hence, it’s a great opportunity to invest in Thailand too. Without a doubt, Thailand is one of the best destinations for finding quality jewelry. Not only because jewelry is deeply ingrained in the culture, but it has a stable Climax, no power interruptions, easy regulations, easy doing, and low cost of doing business. If you are not convinced that this is where you should get your jewelry manufactured, instead of China, read on and discover reasons why Thai-based jewelry manufacturing is the path to success.

Latest News on Doing Business in China Vs Investing in Thailand

Full Lockdown in the main Cities

China began its most extensive coronavirus lockdown in two years. Shanghai, China’s financial capital and largest city is undergoing a five-day lockdown amid a growing outbreak. Millions more have been kept in lockdown since then. Offices and all businesses not considered essential will be closed and public transport suspended. The overall impact is still great.

With China’s economic growth already slowing, the extreme measures are seen as worsening difficulties hitting employment, consumption, and even global supply chains. With a 21-day curfew in place for all foreigners arriving from abroad, travel between China and other countries has fallen dramatically.

Energy Supply Shortage

China is currently facing multiple problems, from supply shortages to the power crisis, with power issues being the third biggest problem, as a massive number of their factories shut down.

High coal costs and inflexible electricity prices have caused shortages that forced local governments to implement rolling blackouts for energy-intensive industries. China’s energy crisis pushed the government to extend power restrictions in at least 20 provinces and regions as it struggled to cope with the power shortage that affected more than 66% of the country’s gross domestic product.

Several companies closed their operations as millions of homes in the country faced a blackout situation. There are remaining concerns over whether further blackouts will occur, and what impact the current situation with supply shortages and supply chain issues may have in the longer term.

If there is no energy, factories are on kind of a complete standstill, and when factories are on standstill, not producing any goods; what we’re seeing is the global impact it has by highlighting how many countries have been and are reliant on China. Even the country has struggled to balance electricity supplies with demand in the past, which has often left many of China’s provinces at risk of power outages.

As the country struggles with energy shortages, it would be a great risk for manufacturers from different countries and is something that could have implications for the rest of the world.

Rising Inflation

China’s inflation rose more than expected in March as COVID-19 lockdowns and the fallout of the war in Ukraine pushed up prices in the world’s second-largest economy.

China’s producer price index (PPI), which measures factory inflation, increased 8.3 percent year on year, according to data from the National Bureau of Statistics (NBS) released on Monday, amid rising energy prices and persistent supply chain disruptions.

Soaring factory inflation in the world’s second-largest economy could exacerbate rising prices worldwide.

Challenges of Doing Business in China

The Crisis in Chinese e-commerce giant Alibaba

China’s largest company, Alibaba Group Holding Ltd., of tycoon Jack Ma which is considered an e-commerce behemoth was said to be in the “most critical” moment in the development of finance. The sudden cancellation of Ant Group’s IPO with Alibaba shocked investors, but Beijing’s slapdown of Jack Ma was years in the making. Alibaba and Ant aren’t the only tech firms under scrutiny by Chinese regulators.

The war between China’s government (President Xi’s) and Jack Ma’s influence, which underestimate the power of China’s state-owned enterprise, resulted in rules restraining finance activities. This chaotic scenario greatly affects China’s prosperous economy and supply chain situation.

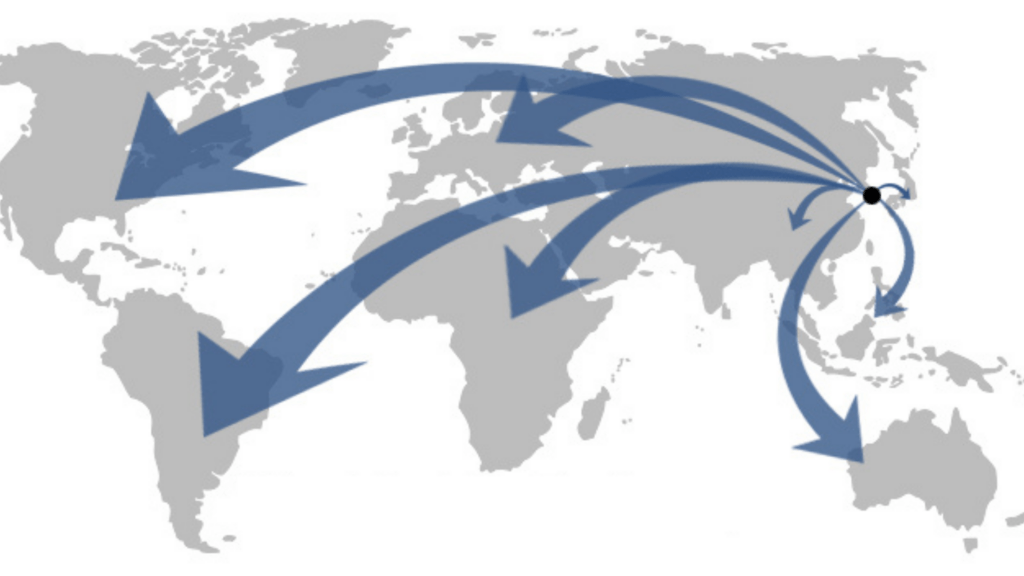

Famous Firms Moving Out of China

Big multinational companies are moving out of China as the US-China trade war rumbles on and relations between other liberal democracies and Beijing deteriorate due to everything from intellectual property (IP) theft to human rights violations in Xinjiang and the eroding away of Hong Kong’s autonomy. Coronavirus-related sales slumps and supply chain disruption and rising production costs have also hastened the exodus.

Many globally-renowned companies are deserting China such as Nike, Apple, Samsung Electronics, LG Electronics, Adidas, Puma, Zoom, Sharp, Hasbro, Kia Motors, Hyundai Motor Group, Hyundai Mobis, Stanley Black and Decker, Dell, HP, Google/ Alphabet, Microsoft, GoPro, Intel, Sony, Nintendo, Under Armour, Steve Madden, Old Navy/Gap, Superdry, Space NK, The New York Times, Naver, and Quanta Computer.

These famous firms opted to pivot production away from China and moved their manufacturing from one country to another due to a drop straight down at a high speed of sales. Others saw its sales plummet on Chinese e-commerce giant Alibaba after the company took a stand against the treatment of Uyghurs in the Xinjiang region.

Companies which make more than a quarter of their products in China are keen to diversify their manufacturing base and supply chains, by producing more of their products in different countries. Some are suffering from the global shipping container shortage that is preventing goods from being transported from China.

The suppliers of sportswear colossus have been relocating production facilities to Southeast Asia and Africa. As well as tech giants are also planning to have 30% of their products produced in Vietnam.

Smartphone factories in the country ceased their production and moved to factories some near Bangkok, Thailand.

US teleconferencing platform Zoom skyrocketed in popularity during the COVID-19 pandemic, but while the firm behind the app is going from strength to strength, opening new data and R&D centers in India and the US, it announced it was stopping direct sales to customers in mainland China. Its video conferencing services are still available via third-party partners.

Automakers and motor groups have also taken steps to shift manufacturing away from China, shutting one of their key plants in the country. They have put the closure down to slumping sales, losing trillions of money in the People’s Republic.

The industrial tools and household hardware maker also permanently closed its factory in Shenzhen China. Growing competition and rising labor and land costs were cited as reasons for the closure.

Google too is more or less blocked in China, but the search engine’s parent company Alphabet still produces hardware products in the country. As supply chains have become disrupted, the tech behemoth has moved manufacturing of its flagship Pixel smartphone to Vietnam and will produce various smart home products in Thailand.

Even in journalism, a step of moving out from China is decided in response to the controversial security law which curtails freedom of speech in the Special Administrative Region. According to the US news outlet, the law “unsettled news organizations and created uncertainty about [Hong Kong’s] prospects as a hub for journalism”.

As relations between the US and China worsened and the trade conflict intensified, all these business giants moved production and supply chains away from China.

Disaster Issues

As China battles with the impacts of Covid-19, new challenges have surfaced. Severe storms and floods have hit the country, particularly in the Yangtze River Basin. By 3 July, flooding had affected 19.38 million people in 26 provinces and resulted in 875,000 emergency resettlements. Direct economic losses had amounted to 41.64 billion yuan (US$6 billion) and counting.

Data from the United Nations shows that between 1998 and 2017, global economic losses caused by climate-related disasters amounted to US$2.2 trillion, with floods being the most frequent type of disaster (43% of all recorded events). Flood impacts are not limited to direct damages, such as to buildings, houses, and infrastructure, but also include indirect costs which are much more complex to account for and as a result often neglected.

The Impacts of flooding on the manufacturing sector are bigger than we thought

The flooding in China could have reduced the productivity of manufacturing companies each year. Sectors closely linked to manufacturing, such as agriculture, oil and gas, electricity and water production and supply, were also likely to be affected. Losses could have amounted to 12.3% of total national output.

How badly manufacturers are affected is dependent on factors such as the size of the company, the resources available to cope, the structure of the supply chain, and the availability of government assistance and insurance mechanisms.

Risks are likely to increase.

Climate change could also affect China’s infrastructure system, the backbone of the manufacturing industry, and its supply chains. All may be at increased risk of flooding. Up to 20% of China’s power plants could be exposed to increasing flood probabilities by 2035 in the best climate scenario and this number increases to 32% in the worst case.

Real Estate Crisis

The ramping up of rhetoric from Beijing in recent months has seen action being taken against a dizzying array of Chinese business interests. Everything from insurance agents, private tutoring firms, real estate developers, and even companies planning to sell shares in the US has come under intense scrutiny.

The technology industry, in particular, has seen a deluge of action against it, including crackdowns on e-commerce firms, online financial services, social media platforms, gaming companies, cloud computing providers, ride-hailing apps, and cryptocurrency miners and exchanges.

These moves are having a major impact on both China’s economy and society, and effects are also being felt around the world. The country has long been seen as the factory of the world, as well as a major engine of global economic growth.

Now, the uncertainty around the regulation of businesses in China is making it difficult for companies from overseas to make decisions about potential investments.

China’s Government involved in free-market

Chinese President Xi Jinping has vowed that by 2049, China would “become a global leader in terms of composite national strength and international influence.”

The Chinese government is indeed aiming for global power and perhaps global primacy over the next generation — that it seeks to upend the American-led international system and create at least a competing, quasi-world order of its own. It reflects Xi’s understanding of what China has accomplished under communist rule and how it must advance in the future.

5 Reasons Why Invest in Thailand Jewelry Manufacturer

China had been pushed into deficit, this is one of the reasons why it’s essential to invest sensibly for business development in the right place at the right time where there is no conflict. China’s situation is theatrical and the future is unpredictable at the moment. Nevertheless, there’s nothing to worry about, we understand the situation. We are ready to help you 360 degrees to run back your business and have less friction as possible.

1. Easy Doing Business with Thai Jewelry Manufacturers

Since Thailand exports such a large quantity of fashion jewelry, silver, and gemstones every year, Thailand jewelry manufacturers exhibit a high degree of skill, professionalism, and attention to detail. Jewelry manufacturers in Thailand are also well-known for excellent after-sales service and are very easy to do business with.

Thai jewelry manufacturers are also well known for their reliability and logistic skill. Thai suppliers of all kinds are more likely to ship on time and experience a limited number of unexpected delays, especially when comparing their performance with other countries in the region.

One necessary reservation that jewelry sellers may have about doing business in Thailand is a perceived difficulty in communicating with their Thai manufacturers. Still, luckily, the overall level of English among Thai business owners and executives is quite good. This means that language barriers won’t be an issue with most manufacturers based in the country.

2. Low Cost of Doing Business

The fact that Thailand is a significant producer of the materials needed for jewelry manufacturing translated to a lower overall cost of finished jewelry products. Add that to the low costs of living and labor that Thailand jewelry manufacturers enjoy, the reason for Thailand’s competitive jewelry prices becomes obvious.

Thailand is an affordable country by many standards, meaning that there are deals on fashion jewelry for everyone from tourists to jewelry sellers based in countries worldwide.

On top of the low costs of living and labor, the Thai government grants duty exemptions for many materials involved in the jewelry-making process, including gold and diamonds, which are not readily found in the country’s mines.

This further allows Thailand jewelry manufacturers to keep their costs and prices low without sacrificing profit, all of which spells good news for sellers in search of a low-cost jewelry supplier.

3. Jewelry Expert For Many Years

With Royi Sal, the jewelry expert for many years, it will be diversifying for business future safety. Looking into the jewelry history of Thailand, it is the most advanced country in South East Asia for the Jewelry design thanks to strong handcraft artist traditions. Thai artists are famous for a long time for their creation, idea, and style.

If your business is significant jewelry brands around the world, could be silver, and brass jewelry casting and stamping, choosing Royi Sal Jewelry in Thailand for production is a great recommendation. The nation is well-known for being a jewelry hub in Asia, and that gives it access to precious stones as well as the skills to cut and polish them. Thailand’s long history of craftsmanship provides the country with the advantage of producing high-quality fine jewelry for many years.

4. Production of Plenty of High-Quality Jewelry and Gemstones

Culturally, wearing jewelry is very common among Thai men and women, which feeds high domestic demand.

Just spend a day driving around Phuket or Bangkok and count the number of jewelry stores you see; respect for beautiful jewelry is truly ingrained in the culture and has been for centuries. The Thais don’t just mine the raw materials or sell the finished jewelry, though they also make high-quality fashion jewelry in huge quantities.

Thailand jewelry manufacturers export tons of jewelry every year, making the country a top ten jewelry supplier worldwide. Thailand supplies the highest amount by the value of silver jewelry (23% of the world’s market share, to be exact) and is ranked third in gemstone exports as well.

This means you’re never going to have to worry about supply shortages when dealing with Thailand jewelry manufacturers; in the Land of Smiles, there’s more than enough supply to go around.

Moreover, numerous gem and jewelry fairs and trade shows are held in the country. The Thai government has prioritized the gemstone and jewelry industry’s promotion, fully aware of its importance to the overall Thai economy.

5. Unique and Quality Jewelry Designs

Low costs and a steady supply don’t mean anything if the designs won’t sell! Luckily, that won’t be a problem if you deal with Thai manufacturers. Given the history of jewelry manufacturing in the country and its competitiveness, jewelry designs fit every taste.

Although traditional Thai jewelry has a very striking and distinct look, Thai jewelry manufacturers don’t limit themselves to recreating their classic styles. From kids’ jewelry and charms to sterling silver and fun nature-inspired designs, you’re sure to find a Thai supplier that can provide you with whatever style you’re looking for.

Most importantly, you can be sure that the products’ quality will be of a high standard. Thai craftspeople have been making desirable fashion jewelry for centuries and take great pride in their work. It’s so easy and profitable to work with Thailand jewelry manufacturers that you’ll wonder why you ever went with anyone else.

Conclusion

Though there are Pros of Manufacturing in China, such as lower costs and higher output/quicker time, economic unpredictability indeed plays a role. Some companies that manufacture their products in China are starting to worry about how it may affect their business.

As a result, many businesses are moving to Thailand. It includes Jewelry Manufacturing Production. So now’s a good time to have an excellent opportunity to invest in Business in Thailand.

In the jewelry industry, it is not affordable to lose time and money. “Now” is the moment to find a quick and high-quality solution to continue running your businesses before it’s too late.

Never put all your eggs in one basket, always consider to have a safe backup. – Mr. Royi Gal

Diversify your business and optimize your ROI.

Don’t get involved in this vague situation. If you are involved in gold, silver, and brass jewelry casting and stamping, I recommend you choose Thailand for your production. The nation is well-known for being a jewelry hub in Asia and that gives it access to precious stones as well as the skills to cut and polish them. Thailand’s long history of craftsmanship gives the country the advantage of producing high-quality fine jewelry for many years.

The country’s labor cost is also very competitive in regard to China, without compromising skills, and there is the necessary quality to deliver the right product for your business. It seems an obvious choice, and it will be if you need to change the country you are using for your jewelry manufacturing purposes.

You don’t need to wait for the Chinese decisions. You can now decide to move some of the production (just for safety) to another location. Some of the big companies have already chosen to relocate their manufacturing lines outside of China to mitigate the risks of getting involved in conflicts. You can also begin developing a plan that will guarantee many benefits to your business, long-term.

Sources:

https://thediplomat.com/2022/03/shanghai-starts-chinas-biggest-covid-19-lockdown-in-2-years/

https://www.aljazeera.com/economy/2022/4/11/chinas-inflation-beats-forecasts-amid-lockdowns-ukraine-war

https://www.lovemoney.com/gallerylist/98705/big-multinational-companies-moving-out-of-china

https://www.bbc.com/news/business-58733193

https://www.bbc.com/news/business-58704200

https://www.bbc.com/news/business-58417234

P.S. Royi Sal Jewelry, as a decades-long leader in silver jewelry design and manufacturing, invites you to download our latest magazine here and profit from the exceptional or best-seller jewelry designs at affordable prices in 2022 you will find in the magazine. Click here to download it now.

Share this post